What is an Initial Coin Offering?

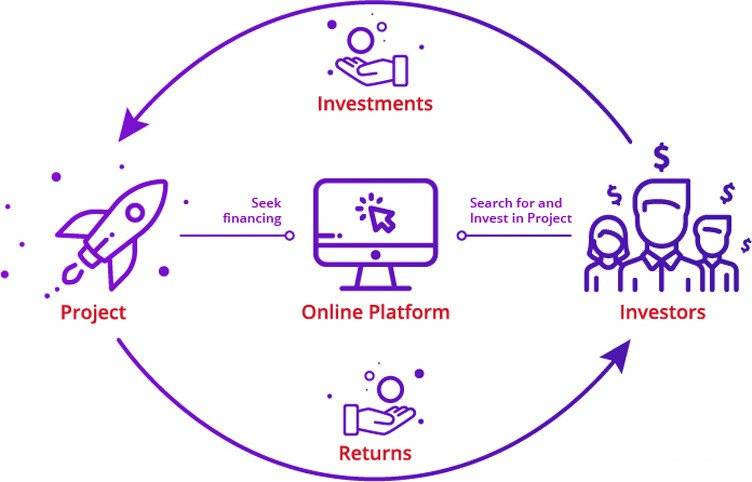

An Initial Coin Offering (also known an ICO) is a type of funding using cryptocurrencies. In an ICO, new tokens are sold to investors in exchange for existing cryptocurrency. These new tokens are promoted as future functional units of currency after the ICO project is completed.

An ICO can be a source of capital for companies looking to raise funds for expansion. ICOs have recently become a popular fundraising method used by start-ups that are typically related to cryptocurrency and blockchain.

Blockchain technology can facilitate the generation of cryptocurrency tokens, making it faster and cost-efficient for companies to raise capital via ICOs. ICO managers generate tokens according to the terms of the ICO and distribute the tokens to investors in exchange for cryptocurrency. The ICO process is explained in additional detail below.

How an ICO Works

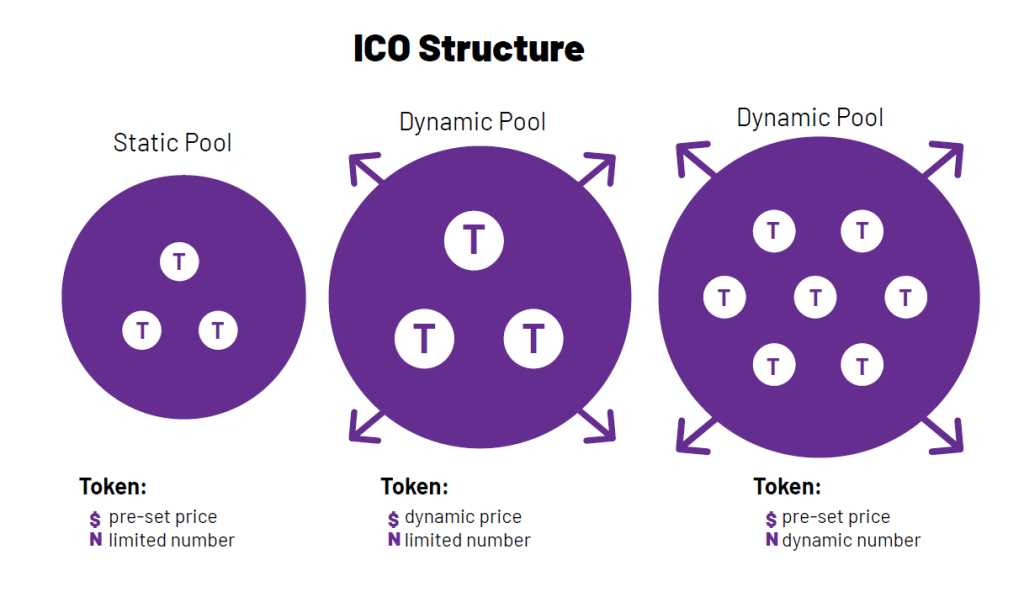

When a company or individual wants to raise money through an ICO, the ICO manager’s first step is to determine how they will structure it. ICOs can be structured in a few different ways:

- Static supply and static price: A company sets a specific funding goal or limit, which means that each token sold in the ICO has a pre-set price, and the total token supply is fixed.

- Static supply and dynamic price: An ICO has a static supply of tokens and a dynamic funding goal. This means the amount of funds received in the ICO determines the overall price per token.

- Dynamic supply and static price: Some ICOs have a dynamic token supply but a static price, meaning that the amount of funding received determines the supply.

In addition to how the ICO is structured, ICO managers need to choose whether they would like to create their own hashing algorithm or “fork a coin” by utilizing existing blockchain protocols from communities. When it comes to creating a token (e.g., fungibility and smart contract capability), the ICO manager will also need to determine which standard to work with, such as Ethereum’s ERC20, ERC223 or ERC721 standards.

How to launch an ICO?

Once you determine the structure and standard you want to use for your new token, you will need to create a white paper, which is a document explaining what your token is and what it aims to do. The white paper should be an engaging and informative document and available to potential investors via a website dedicated to the token. The white paper is used to explain important aspects of the ICO:

- What the ICO is about and what problem does it solve

- The amount of funds that needs to be raised for the ICO to be successful

- How many of the virtual tokens the founders will keep?

- What types of which currencies will be accepted

- Schedule and key dates of the ICO campaign

In the fundraising stage, the cryptocurrencies collected should be stored in escrow using a crypto wallet. If the funds raised in an ICO is less than the minimum amount required by the ICO’s criteria, then the ICO would be unsuccessful, and all the cryptocurrencies should be returned to the project’s investors. If the funding requirements are met within the specified time period, then the funds raised can be spent in pursuit of the ICO project.

Creating tokens on the blockchain is a highly technical and complex process, which is why specialist skills and capabilities are essential to launching a successful ICO. Finding high-quality developers for your ICO or blockchain-related project will be paramount to the success of your project. One of the most important decisions you will make is hiring an experienced and specialist developer like TokenMason to successfully launch your token. TokenMason’s services are discussed in section below.

How TokenMason Can Assist

We hope you have found this blog useful and learned more about ICOs and how they work. TokenMason welcomes the opportunity to discuss how we may be able to assist. Please visit our Blog page for more blockchain and crypto-currency related news and articles.

TokenMason is a leading blockchain development company and helps organizations build customized blockchain solutions such as launching ICOs, ICO consulting, developing cryptocurrency, smart contracts, blockchain-related apps, decentralized exchanges and other blockchain-related projects.

Submit an enquiry if you would like to receive a quote for your customized blockchain project or discuss a strategy to make your blockchain-related idea a reality. TokenMason welcomes the opportunity to discuss how we may be able to assist.